Downtown Bellevue Pop-Up Dog Park

Have you visited Wildwood Park just south of Main Street in recent weeks? You may have noticed one of three new pop-up dog parks.

Bellevue Parks & Community Services has launched a pilot program to create safe and accessible spaces for pets and owners to play, socialize and exercise. Other pop-up parks are at Wilburton Hill Park and in Crossroads Park. These dog parks are part of the City’s 2022 Parks & Open Space System Plan to provide off-leash areas near downtown and other underserved neighborhoods.

The parks are fenced, have safe double entry gates, dog waste bag dispensers and waste cans. The temporary status could change depending on popularity and costs to convert to permanent installations. Feedback has been positive so far and two additional dog parks will be popping-up in Lincoln Center and just north of City Hall.

Stop by the Wildwood Park park and give your four legged family member chance to mingle with local pups and their people.

Visit Bellevue’s Park’s & Community Services website for more information.

AND DON’T FORGET . . . Friday, June 23rd is National Take Your Dog to Work Day

Summer Outdoor Dining Returns to Old Bellevue

You can tell it’s summer. Main Street is festively decorated with new and familiar al fresco dining opportunities serving breakfast, lunch and dinner. Enjoy temporary street side dining through early fall or familiar year round patios at at several restaurants, bistros and cafes offering a variety of cuisines, desserts, coffees and people watching. Many patios are dog friendly and welcome well mannered pups.

Take a few steps off Main Street . . . located between Main Street and the Downtown Park you’ll find more opportunities to satisfy your palate, caffeine craving or sweet tooth.

Calling All Dogs

Bellevue’s annual dog jog and walk event is just around the corner.

Bellevue’s annual dog jog and walk event is just around the corner.

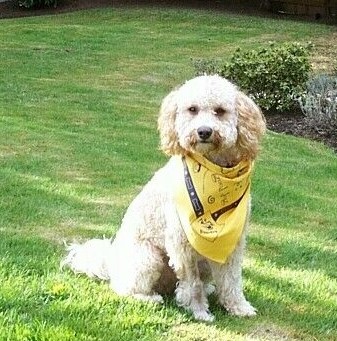

This year’s Inaugural Paws & Pride Dog Jog and Walk is scheduled for Sunday, June 4th at Ashwood Park. This year’s annual downtown Bellevue event benefits Seattle Humane of Bellevue and Lambert House. Registration is open for individuals/$25, pairs/$40 or $50 for a 4-pack. After the walk events continue at Ashwood Park with KidsQuest Children’s Museum activities, vendors and booths highlighting pets and LGBTQIA+ organizations and sponsors. All participants receive goodie bags and customized event bandanas

For more information and event registration or to volunteer visit: https://www.bellevuedowntown.com/events/paws-and-pride-dog-jog-and-walk.

Opening Day – Bellevue Farmers Market

It’s that time of year again, and a sure sign of spring/summer’s arrival. Opening day of the Bellevue Farmers Market is this Thursday, May 18th. The market is located at the Bellevue Presbyterian Church (1717 Bellevue Way NE). Access the market and parking area off of Bellevue Way. There’s ample parking available.

Market hours are 3:00 PM – 7:00 PM.

Windermere Foundation Reaches Its $50 Million Goal

For over 30 years the Windermere Foundation has donated a portion of the proceeds from every home purchased or sold through Windermere Real Estate. What started as a mission to serve families in need in Washington State now includes ten states in communities where Windermere operates. In 2022, Windermere’s 50th anniversary, the company set a goal to reach $50 million in total donations, launching the “50 in 50” campaign. An amazing goal and an amazing accomplishment. Windermere succeeded in raising over $50 million for programs and organizations that provide shelter, clothing, children’s programs, emergency assistance and other services to those who need our help the most.

For over 30 years the Windermere Foundation has donated a portion of the proceeds from every home purchased or sold through Windermere Real Estate. What started as a mission to serve families in need in Washington State now includes ten states in communities where Windermere operates. In 2022, Windermere’s 50th anniversary, the company set a goal to reach $50 million in total donations, launching the “50 in 50” campaign. An amazing goal and an amazing accomplishment. Windermere succeeded in raising over $50 million for programs and organizations that provide shelter, clothing, children’s programs, emergency assistance and other services to those who need our help the most.

It is an honor to be part of the Windermere family and support the Windermere Foundation. Funds raised go directly to support many organizations assisting low income and homeless families throughout our local communities.

Learn more about the Windermere Foundation at windermerefoundation.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link