Eastside Condo Sales Activity

As was true across the Puget Sound region, the inventory of available houses and condos for sale on the Eastside dropped dramatically in November.

As was true across the Puget Sound region, the inventory of available houses and condos for sale on the Eastside dropped dramatically in November.

- the median sales price was $900,000, up 2% over last year

- 20% of those homes sold above list price

- 45% of the homes sold in 15 days or less

- the Eastside currently has only 1.3 months of available inventory

- current inventory levels favor sellers

- continuing low interest rates favor buyers

Most of the Eastside condo sales activity was in downtown Bellevue and downtown Kirkland.

- $884,000 Downtown Bellevue median condo sales price in November

- there are currently only 20 condos for sale in downtown Bellevue; 35 in all Bellevue zip codes

- $617,500 Downtown Kirkland median condo sales price in November

- there are currently only 14 condos for sale in downtown Kirkland; 46 in all Kirkland zip codes

It’s a great time to buy a home. Low interest rates (under 4%) make it an ideal and affordable time to purchase a home. There are great loan program options for qualified buyers offering as little as 3% down for conventional or FHA financing.

It’s a great time to sell. With little inventory for buyers to choose from, January will be an ideal time for homeowners to put their homes on the market and stay ahead of the competitive spring market.

Home Search – What’s more important? Location or dream home updates?

Seafair, vacations, weddings, sunny weather, back-to-school shopping – the month of August is filled with distractions that cause buyers to take a break from their summer home search. Local condominium and house inventory is up (though there’s hardly a glut of available inventory), making this a great time to take advantage of having more homes to choose from, less competition from other buyers and the benefit of very favorable interest rates.

Searching for a home always comes with a list of needs/wants. An important thought to keep in mind . . . if a particular neighborhood or manageable distance to work or schools is important, that should be your priority and always at the top of your list, even if inside it isn’t your dream home. Location is everything, and it can’t be changed once you realize your commute is too long. Buyers should be open to making compromises on cosmetic finishes and fixtures. White appliances, a boring back splash or tired bath fixtures are easily updated. The “perfect” home may already have those sexy finishes and fixtures, but they will come at an added expense which may mean compromising on location to stay within your budget.

Keep location and condition (not updates) as your top home search priorities. If you start with the right location, and the home is well maintained (an inspection is always recommended), you’ll be way ahead of the game. Simple compromises on finishes and fixtures (easily be replaced) and maintaining the focus on location and access to amenities and services, will gain you more value and ultimately a better return on your investment. Don’t stretch your budget for stainless appliances, a glass tile back splash or cool pendant light fixtures. That boring white refrigerator will keep food, milk, beer and wine just as cool as a sexy stainless refrigerator and will serve its purpose until you can upgrade appliances, fixtures, etc. to fit your decor and your budget.

Robin Myers is a broker with Windermere Real Estate/East, Inc., specializing in condominium residences.

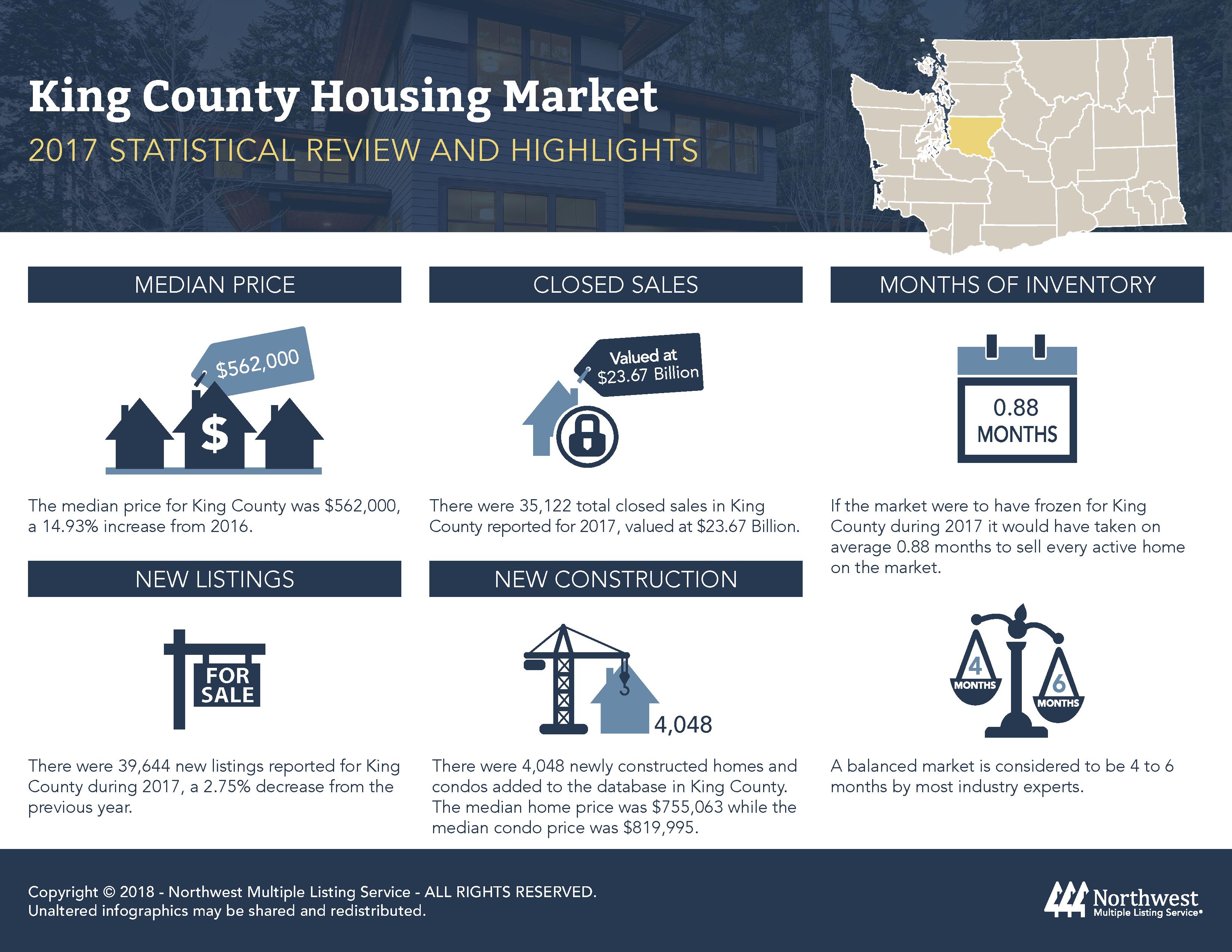

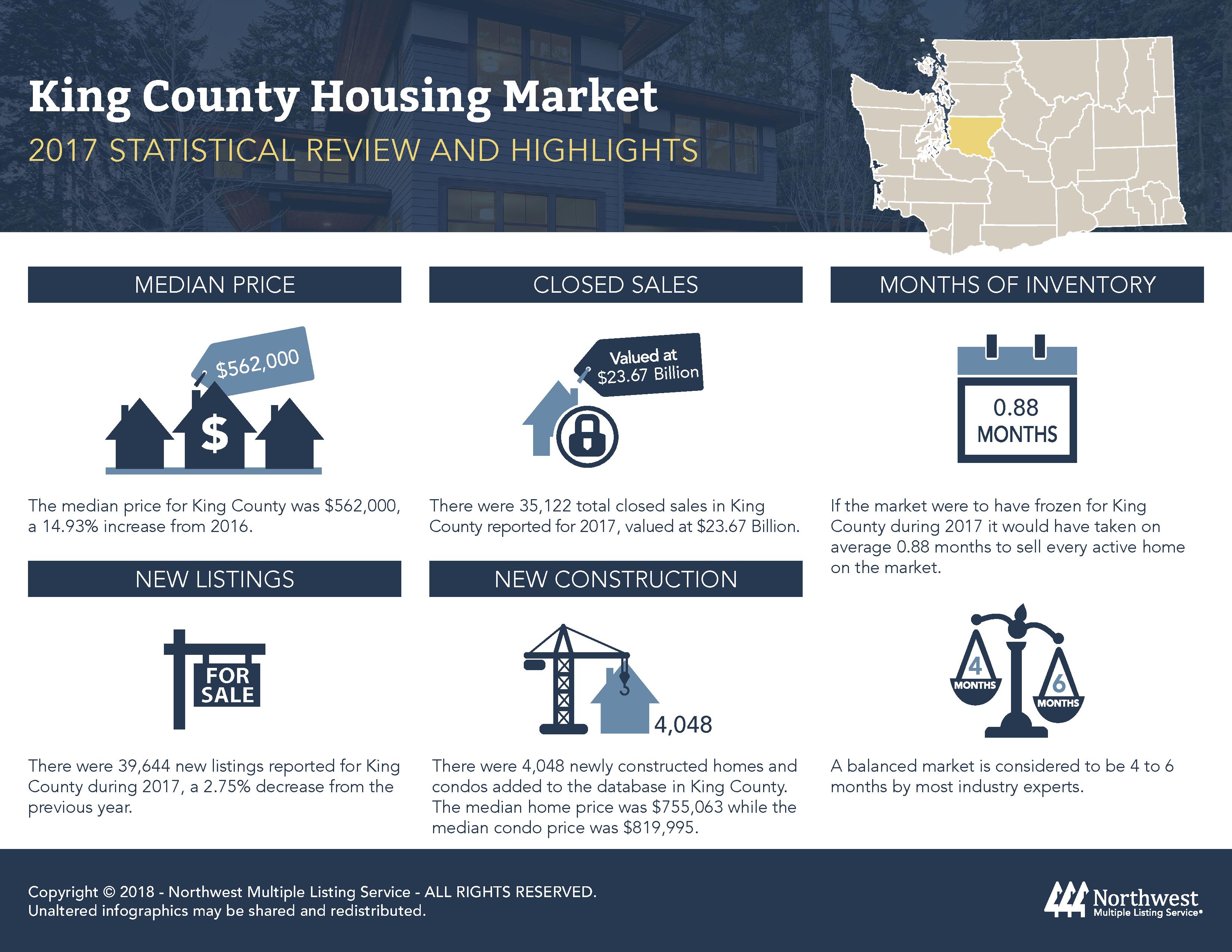

2017 Local Real Estate Market Data

The info-graphic above provides a quick look at 2017 King County real estate market statistics.

- nearly 3% more homes (condos and houses) sold in 2017 vs. 2016

- the median sales price was up nearly 15% county-wide

- at the end of 2017 there was less than a one month supply of available homes

- a 4 – 6 month supply is considered normal – we haven’t sen a “normal” level of supply for 2+ years

Six weeks into 2018 the stats haven’t changed much. Homes are coming on the market slowly and are selling quickly. Inventory still can’t meet buyer demand. The “spring” market generally opens up in mid-to-late February. Hopefully there will be more condos and houses available as the weather begins to warm.

The take away . . .

- Planning to sell? Buyer demand is high but condition and location are still important selling factors.

- Ready to buy? Position yourself to be a strong buyer. Meet with your lender and obtain a current loan pre-approval . Work with your Realtor® to educate yourself on neighborhoods, schools, recent sales prices and list vs. sold statistics, commute times, etc.

- Expand your options – maybe the home that fits your lifestyle isn’t a house. Don’t rule out a condo or townhouse which can offer a single family lifestyle with lower maintenance responsibility, a great alternative if you don’t want a lot of yard or exterior home maintenance.

2018 is expected to be another challenging real estate market for buyers and sellers. Be patient. Be flexible. Be ready to move quickly.

Robin is a Realtor® with Windermere Real Estate/East. She lives and works in Bellevue and specializes in the Eastside’s condo and townhome communities.

Time to Sell an Investment Property?

Interest in rentals remains strong, but there’s been a noticeable slight decline in area rents this year. Even in high demand urban areas, rents have dipped slightly. With thousands of new apartments recently completed or nearing completion, and hundreds more under construction, rental supply may have begun to outpace demand.

If you own a rental property there will be more competition the next time you negotiate a lease renewal. Hundreds of new apartments are available offering modern finishes, new appliances, high tech features and a long list of community amenities and services. Tenants may not be as quick to accept a rent increase or lease renewal when, for the same money, or attractive lease-signing incentives, they can move into newer digs.

If you’ve owned your investment property for a while, this may be the time to sell and maximize your return on investment. Available inventory for sale is at historic lows and buyer demand is at an all time high – the perfect storm if you’re a seller. Properties sell quickly, often with multiple offers. Renting or selling, your property needs to be in good condition, but any minor cosmetic investment will translate to a major return when you sell.

Need market information? I’ve lived and worked in downtown Bellevue for over 30 years – there isn’t much I don’t know and love about the city. A Realtor® and condo specialist for over two decades, I combine my knowledge of the city with years of condo experience to advise and guide clients through the process of buying or selling a home.

Buying a Home with Less than 20% Down

It’s a common misconception that a minimum 20% down payment is required to purchase a home. Buyers, saving to put 20% down on a home purchase, could be missing the opportunity to buy a home, and instead are watching prices continue to escalate.

It’s a common misconception that a minimum 20% down payment is required to purchase a home. Buyers, saving to put 20% down on a home purchase, could be missing the opportunity to buy a home, and instead are watching prices continue to escalate.

There are excellent loan programs available with 5% or 10% down (even as little as 3.5%), requiring less cash out-of-pocket for buyers. A lower down payment may likely result in a somewhat higher monthly payment, but when you consider that houses and condos in the Seattle/Bellevue area have increased in value 14% or more so far this year, and expected to continue to increase in value next year, waiting to buy could prove to be more costly. With rents also on the rise, it could make more sense to buy this year and start putting money toward building equity rather than toward another rent increase next year. Continue reading

2016 Strong for Condo Sellers

With only 24 resale condos listed for sale in downtown Bellevue there are very few choices for buyers ready to purchase. (Add in the 39 developer owned units still available at Washington Square and the total is barely over 60 in the entire downtown marketplace).

Inventory is at historic lows, prices are at or near record highs, multiple offers are the norm, higher buyer demand continues and there's no new condo construction in site . . . this year may well be your best time to sell your home or investment property. Bellevue is continuing to grow, more companies are moving to the city than are leaving, the arts and social scene is thriving, some of the best shopping and dining north of San Francisco can be found in Bellevue and the city is in the center of an award winning school district. The city has so much to offer for a variety of lifestyles and budgets. Condo prices start in the mid $300,000s (yes, there are affordable condos downtown) and can skyrocket to several million for a view penthouse. Don't miss the opportunity to maximize your return on investment if you're ready to make a change, find more space, move up to a view or reinvest in another rental property. 2016 could be the year.

Condo Insurance – what you need to know

Condo insurance, what could be more boring. Did you know . . .

Most homeowner associations carry a master insurance policy which covers damage to a community's residential buildings and parking structures. The HOA may also carry additional earthquake insurance. As a homeowner you need to understand what coverage falls under the HOA's master policy and what coverage you are responsible for having.

- Mold is almost always excluded on the HOA general liability insurance policy. Other exclusions may include damage from water incidents, insects, animals, "acts of God" and vandalism.

- While some condo insurance policies may provide some amount of coverage for damage within a unit, the HOA's general liability insurance policy almost never covers an owner's personal property.

- Condo owners are strongly encouraged to obtain their own personal insurance policy to cover their personal property as well as provide coverage for items/circumstances not covered in the association's policy and deductibles. (Some HOAs may require owners to provide proof of insurance.)

- Definitions of unit boundaries for HOA policy insurance coverage vs. owner policy insurance coverage can be found in the association's Declarations (also called the Covenants, Conditions and Restrictions or CC&Rs.)

- If a condo owner rents the condo, it is a good idea to require and obtain proof that the tenant has a renter's policy to insure the tenant's personal property.

If you are selling a condo, the HOA master insurance policy is one of the documents a seller must provide to the buyer. This document will be required by the buyer's lender and escrow as part of the buyer's loan approval and closing documents.

For more information about your condo's insurance coverage contact your association manager or your insurance agent.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link