NEW FHA GUIDELINES OPEN OPPORTUNITIES FOR HOME BUYERS

Condominiums are an important part of the housing market, especially for first time buyers. Often buyers have the income and credit score needed to purchase a home but lack a substantial down payment which can make entering the housing market prohibitive.

In an effort to promote affordable homeownership for credit worthy buyers, the Federal Housing Administration (FHA) has issued new guidelines that make FHA condo financing an easier, more streamline process. Once a huge part of the first time buyer market, FHA’s strict guidelines made financing a condo difficult, at best. FHA updated its condominium financing rules, effective October 15th, which will loosen requirements for financing condos.

- Low Down Payment Still Available. Buyers can still purchase a home with as little as a 3.5% down payment.

- FHA Loan Limit. In King County the maximum FHA loan amount is $726,525.

- Single Unit Approvals (“spot loans”) Return. If a condo community wasn’t on the approved FHA list, it was difficult, at best, to obtain FHA financing. New guidelines now make it easier for an individual unit to be approved for FHA “spot loan” financing in a community that doesn’t have current FHA approval.

- FHA Certification and Recertification. Many condo communities have applied for and maintained their FHA certification. Having FHA certification makes a community more desirable to buyers and FHA financing much easier. The FHA condo certification now lasts 3 years vs. 2 and the recertification process has been streamlined.

- Owner/Occupancy Requirements Eased. FHA now requires a condo community be just 50% owner occupied.

- Commercial/Non-residential Space. The amount of permitted non-residential space (retail, commercial, parking, etc.) has been increased from 25% to 35%

These updated FHA loan guidelines will now allow thousands more condominium units to qualify for FHA financing, opening homeownership opportunities to many more qualified buyers. Opening the window to homeownership will encourage more owners to buy and occupy homes resulting in fewer investor owned/rented units, higher owner occupancy levels and stronger communities.

NEW FHA LOAN GUIDELINES FOR CONDOMINIUMS BENEFIT BUYERS

Condominiums are an important part of the housing market for first time buyers. Too often buyers have the income and credit score needed to purchase a home but lack an adequate down payment which can make entering the housing market prohibitive.

In an effort to promote affordable and sustainable homeownership, especially among credit-worthy first time buyers, the Federal Housing Administration (FHA) has recently issued new guidelines making obtaining FHA financing for condominiums an easier and more streamline process. FHA has issued an update to its condo rules, effective October 15th, that will loosen requirements for financing condominiums. Here are some of the more important changes effective this month:

- Low Down Payments Still Available. Buyers can still purchase a house or condominium with as little as a 3.5% down payment

- FHA Certification and Recertification. FHA requires a condominium community to have obtained FHA certification. It is a detailed process and there is an expense to the HOA involved, but once complete, having FHA certification makes a community more desirable to buyers and FHA financing much easier. The FHA condo certification now lasts 3 years vs. two and the recertification process has been streamlined.

- Single Unit Approvals (spot loans) Permitted. In the past, if a condominium community wasn’t on the approved FHA list, it was difficult, at best, to obtain FHA financing. The new guidelines now make it easier for an individual unit to be approved for FHA “spot loan” financing in a community that isn’t FHA approved as long as no more than 10% of the units in the community are FHA insured. (A buyer must use a FHA approved lender.)

- Owner Occupancy Requirements Eased. FHA now requires that a condo community be just 50% owner occupied.

- Commercial/Non-Residential Space. The amount of permitted non-residential space (retail, commercial, parking) has been increased from 25% to 35%.

These updated FHA loan guidelines will now allow thousands more condominium units to qualify for FHA financing, opening homeownership opportunities to many buyers. Homeowner associations are encouraged to obtain and maintain FHA certification. Opening the window to homeownership will encourage more people to buy and occupy homes resulting in fewer investor owned units, higher owner/occupancy levels and stronger communities.

Renting Your Condo? What You Need to Know About New Washington State Landlord-Tenant Laws

Washington State Landlord-Tenant Laws were revised in July that include new tenant protection laws relating to rent increase and eviction notices and changes to property use. If you currently have tenants renting your condominium (or house), or you’re thinking about renting your condo, here is a quick look at recent changes to the state landlord-tenant laws.

LONGER NOTICE FOR RENT INCREASES

Landlords must now give tenants 60 days written notice for rental increases. Previously 30 days notice was required for rent increases.

LONGER NOTICE FOR ECONOMIC EVICTION

Landlords are required to give 14 days notice (previously 3 days) before evicting a tenant based on overdue rent. That notice must include information on the tenant’s obligations, rights and options along with the total amount due, broken down by type of charge. Tenants can’t be evicted for failing to pay costs outside of rent and utilities (late fees, deposits, landlord’s legal costs, etc.). Landlords can pursue other ways to collect those costs.

NOTICE FOR CHANGE TO THE BUILDING’S USE OR DEMOLITION

Landlords are required to give tenants at least 120 days written notice to vacate if they plan to change the property’s previous use in any way that would displace the tenants (changes to rules/use regarding pets, smoking, etc.).

For additional information and clarification, landlords should refer to the current State of Washington Residential Landlord-Tenant Act to be sure they, and their tenants, are in legal compliance with state law. Landlords should also check with their condominium association manager to be sure they are in compliance with HOA rules and regulations before moving a tenant into a condominium.

Home Search – What’s more important? Location or dream home updates?

Seafair, vacations, weddings, sunny weather, back-to-school shopping – the month of August is filled with distractions that cause buyers to take a break from their summer home search. Local condominium and house inventory is up (though there’s hardly a glut of available inventory), making this a great time to take advantage of having more homes to choose from, less competition from other buyers and the benefit of very favorable interest rates.

Searching for a home always comes with a list of needs/wants. An important thought to keep in mind . . . if a particular neighborhood or manageable distance to work or schools is important, that should be your priority and always at the top of your list, even if inside it isn’t your dream home. Location is everything, and it can’t be changed once you realize your commute is too long. Buyers should be open to making compromises on cosmetic finishes and fixtures. White appliances, a boring back splash or tired bath fixtures are easily updated. The “perfect” home may already have those sexy finishes and fixtures, but they will come at an added expense which may mean compromising on location to stay within your budget.

Keep location and condition (not updates) as your top home search priorities. If you start with the right location, and the home is well maintained (an inspection is always recommended), you’ll be way ahead of the game. Simple compromises on finishes and fixtures (easily be replaced) and maintaining the focus on location and access to amenities and services, will gain you more value and ultimately a better return on your investment. Don’t stretch your budget for stainless appliances, a glass tile back splash or cool pendant light fixtures. That boring white refrigerator will keep food, milk, beer and wine just as cool as a sexy stainless refrigerator and will serve its purpose until you can upgrade appliances, fixtures, etc. to fit your decor and your budget.

Robin Myers is a broker with Windermere Real Estate/East, Inc., specializing in condominium residences.

Don’t Ignore Condo Resale Disclosure Documents

In this fast paced, competitive real estate market, it’s common, in an effort to “win”, for buyers to waive contract conditions such as inspection, financing, appraisal, neighborhood review, etc. Buying a condominium is different than buying a house. With condominiums perhaps the most important contract condition in place to protect a buyer is the homeowner association (HOA) resale disclosure documents. The State of Washington requires a seller to provide the HOA resale disclosure to a buyer upon mutual acceptance and the buyer has the right to review and approve or disapprove based on the information contained in the package.

What is a resale certificate? It is a set of documents typically assembled by the condominium’s association manager that includes the summary “resale certificate” which discloses information about the HOA, delinquencies, pending special assessments, HOA reserve account balance, owner occupied vs. rental units, pending lawsuits, etc. Supporting documents will include detailed information about the HOA’s budget and financial statements, reserve study, meeting minutes, rules and regulations, recorded Bylaws and Declaration and insurance.

This is a large package of detailed information which too often buyers glance at briefly or ignore totally. It’s important to understand the health of the HOA and how well it is functioning, how well funded the reserve account is, and what conditions or community rules and regulations could impact a buyer’s planned use of the property.

What should you look for? The recorded Declarations can be hundreds of pages, which is overwhelming. There are major pieces you should review, but it’s wise to spend some time going through all the documents to understand how the HOA is governed and how owner’s monthly assessment dollars are being spent.

Resale Certificate – A 5-7 page document highlighting the major elements of the HOA (owner occupancy, delinquencies, reserve balance, special assessments, lawsuits, etc.).

Budget and financial statements – Review the annual financial statements and current operating budget to see the line-by-line operating expenses. Is the HOA staying within budget? Is the HOA building adequate reserves? Is the HOA financially healthy? Continue reading

Does Walk-ability Add Home and Community Value?

Living in communities close to workplaces, shopping, dining and other amenities is becoming increasingly important to buyers when searching for a home. A recent survey conducted on behalf of the National Association of REALTORS® found over half of the respondents preferred to live in a community that offered smaller or no yards but was within walking distance of local amenities and offered shorter work commutes.

Buyers no longer look at just the house – equally, or even more important, is the community and access to workplaces, shopping, dining, transportation, schools, health care and parks or open space. Women tend to put more importance on walk-ability and public transit than men but overall nearly 40% said having public transit nearby was important. Sixty percent of those surveyed would be willing to pay more to live within walking distance of parks, restaurants and shops.

In Bellevue the popularity of urban living was recently confirmed when the One88 condominium residences celebrated the grand opening and sales event. Over 80% of the homes sold in just weeks with buyers committing to reservations to purchase homes that won’t be available for two years. Several new Bellevue townhome communities have experienced the same robust sales activity with buyers committing to pre-sales for homes not scheduled for completion until late spring or summer. Resale condos and townhomes throughuot the eastside, walk-able to urban amenities and workplaces, are experiencing the same high level of buyer interest.

Make Your Next Move with Minimal Stress

Downsizing can happen at any phase of life and for many reasons. Moving, if it involves a major lifestyle change, can be an especially difficult and emotional process. Whether you’re moving yourself or assisting a family member or friend, there are ways to make the process easier and less stressful.

Define, or Redefine Your Needs

If you’re moving to a smaller home, compromising on space doesn’t need to mean compromising on lifestyle. Think about how you currently use your existing space, what rooms go unused on a daily basis, how much time you spend on upkeep, plus the expense. Then look at how you would ideally like to set up a new space to maximize not only how you would use the space but also how it could be a better fit for your lifestyle.

Must Have, Should Have, Could Have and Won’t Have

Downsizing is a compromise, and while it may feel like there are sacrifices, in the end it will be well worth the effort. Make a list of what must go with you and what won’t fit into your new home. Couples can make separate lists and then collaborate to revise them if needed (this works for the kids too). An easy exercise is to think about leaving everything in your old home behind – then ask yourself what you would absolutely have to replace in order to live comfortably. If there’s a frequently used piece you want to take but it won’t fit in the new space, think about a smaller, more practical replacement that might offer multi-use options.

Use Space More Creatively

Quick tips for making more space with less space:

— Reserve kitchen counter space only for frequently used appliances. Keep other less frequently used items stored in

cabinets.

— Invest in space saving tools (wall mounted magnetic knife rack, drawer/cabinet organizers or roll-out

cabinet shelves so that those items in the back are more easily accessible.

— Look for multi-use furniture – living room ottomans with storage or beds with drawers built-in. Use storage bins

that slide out-of-sight under a bed (great for off season clothing or kid’s toys).

— Is there unused space under a staircase or in the back of a deep closet where custom storage could be created? Continue reading

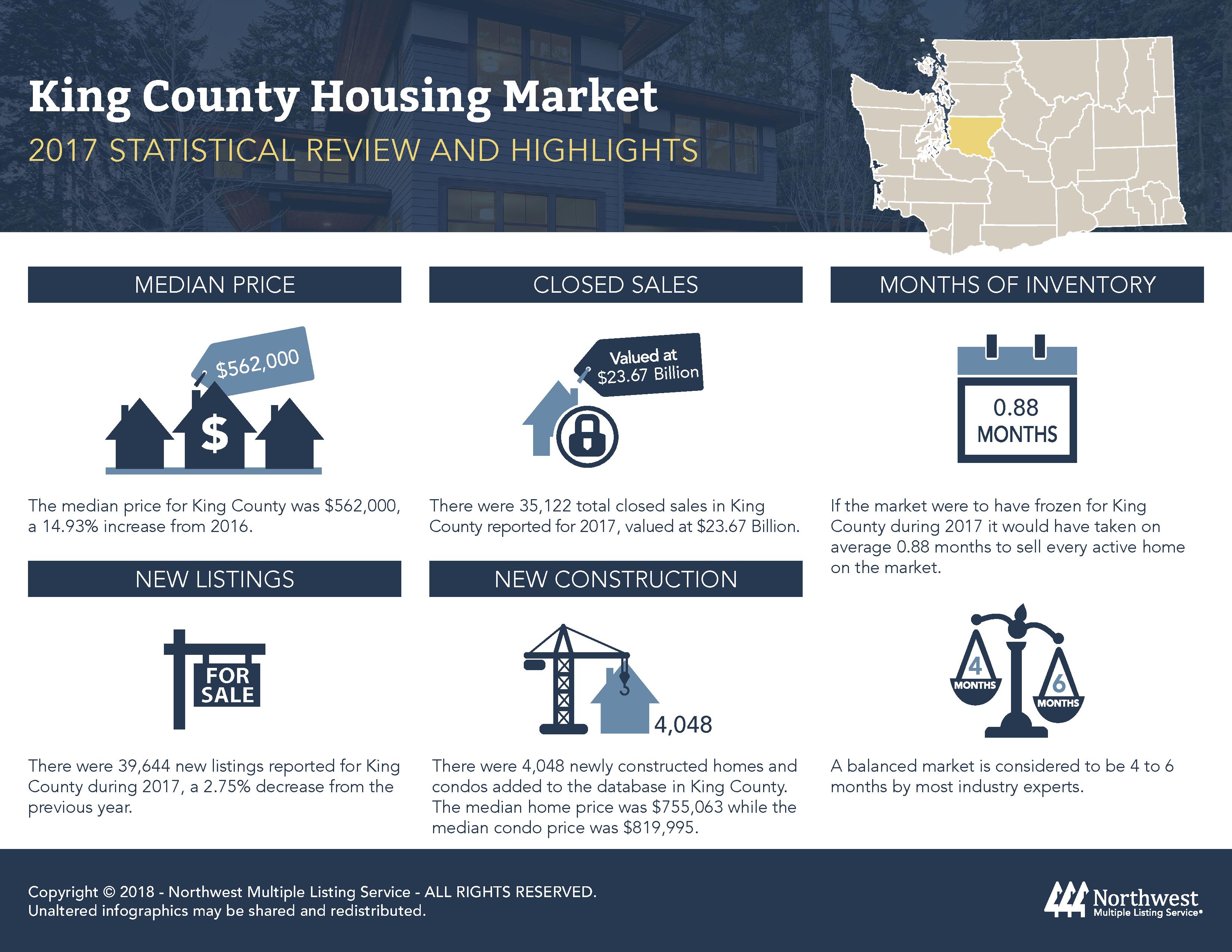

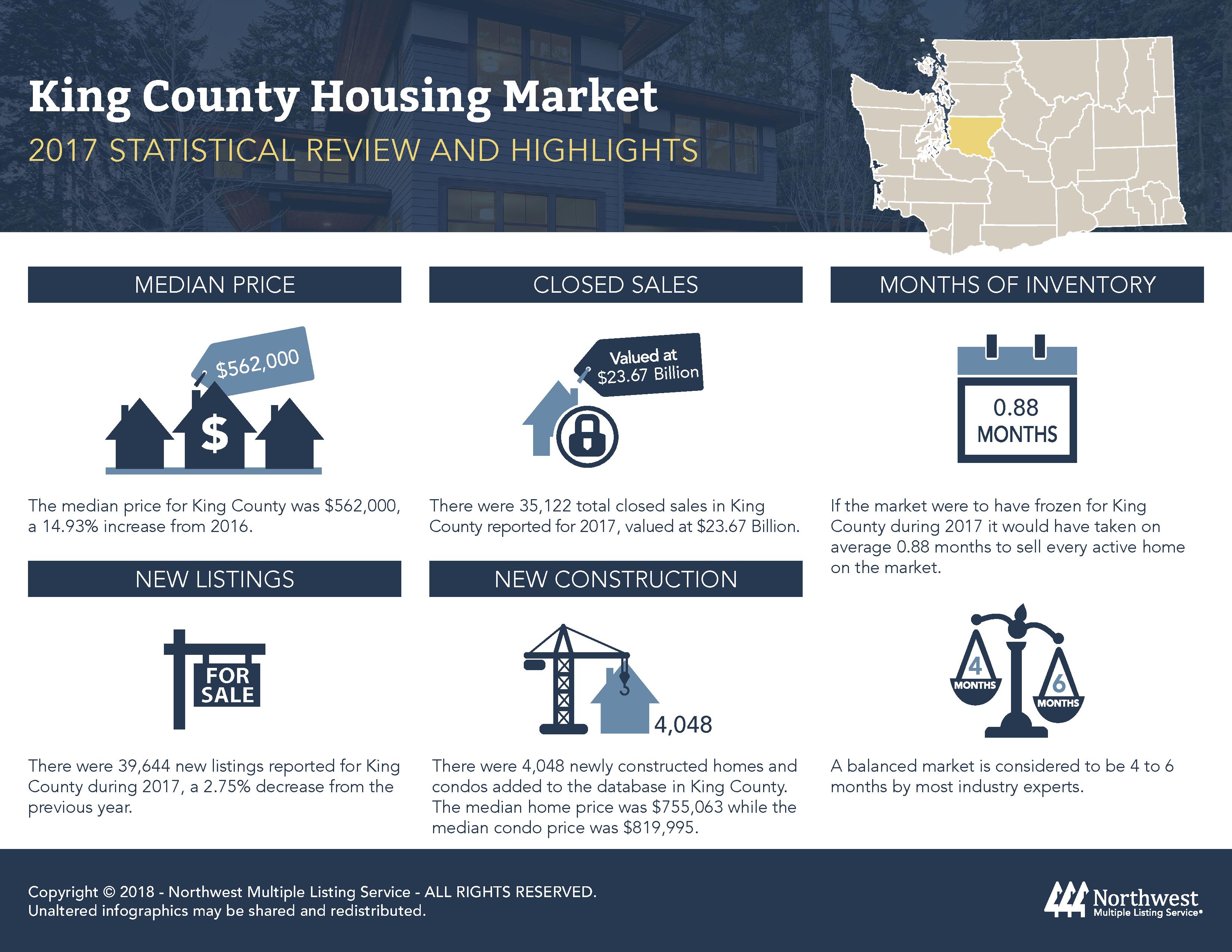

Bellevue Condo Market Statistics

Earlier this month I shared 2017 King County real estate market statistics supplied by the NWMLS. Median sales prices were up 15% county-wide (houses and condos) over 2016. Taking a closer look, here are the 2017 market stats for Bellevue condos:

Earlier this month I shared 2017 King County real estate market statistics supplied by the NWMLS. Median sales prices were up 15% county-wide (houses and condos) over 2016. Taking a closer look, here are the 2017 market stats for Bellevue condos:

- 759 condos sold in 2017 (resale and new construction), up from 746 in 2016 for a 2% increase

- The median Bellevue condo sales price was $500,550 in 2017, up 30% over 2016.

Just eight weeks into the new year stats haven’t changed much. There are just 20 condos available for sale in Bellevue. Newly listed condos are trickling into the market and selling quickly. So far this year 61 resale condos (vs. new construction pre-sales) have sold with an average market time of 15 days. Sales prices are averaging 5.5% over the list price.

This year has already seen an all time record condo sale in Bellevue. A penthouse at Bellevue Towers sold earlier this month for $11,950,000. Custom designed throughout, the home offers 6,398 SF of luxury interior living space plus multiple terraces that add 10,000 SF of outdoor space with 360 degree views.

No doubt the penthouse sale will hold the city/county/state condo sales record for some time, but sales data for the balance of the market is a bit more realistic. Of the 61 resale condos sold since January 1st, sales prices ranged from $202,750 for a 691 SF one bedroom/one bath to $2,237,500 for a 2,615 SF 2 bedroom + den/2 bath penthouse. The median Bellevue condo sales price so far this year is $558,568, but of those 61 sales, 17 (20%) sold for $400,000 or less. Condo values in and around the central business district will continue to command higher prices per square foot, but step just outside the downtown core and prices are far more affordable while still offering easy access to downtown’s workplaces, nightlife and arts and Bellevue’s sought after schools.

Available condos are going to be in short supply for the foreseeable future. A limited number of communities are in design review or under construction, but delivery of those homes is 2+ years away. A few recently completed new communities, mostly multi-level townhomes, are adding new homes to the mix but supply is limited with prices starting in the $700,000s and up. The supply of condos this year is likely to be found in the dozens of existing communities just outside the central business district. They offer a sought after Bellevue address and access to great schools. New construction is very sexy, and the amenities luxurious, but older communities often offer larger floor plans, more green space and more affordable prices. Trading a few blocks of location may gain you a lot of space and lifestyle for less money. Those resale condos are going to be in short supply this year too. If you’re ready to sell, be ready to move quickly. If you’re ready to buy, be ready to act quickly and work with a Realtor® who knows and understands the market.

2017 Local Real Estate Market Data

The info-graphic above provides a quick look at 2017 King County real estate market statistics.

- nearly 3% more homes (condos and houses) sold in 2017 vs. 2016

- the median sales price was up nearly 15% county-wide

- at the end of 2017 there was less than a one month supply of available homes

- a 4 – 6 month supply is considered normal – we haven’t sen a “normal” level of supply for 2+ years

Six weeks into 2018 the stats haven’t changed much. Homes are coming on the market slowly and are selling quickly. Inventory still can’t meet buyer demand. The “spring” market generally opens up in mid-to-late February. Hopefully there will be more condos and houses available as the weather begins to warm.

The take away . . .

- Planning to sell? Buyer demand is high but condition and location are still important selling factors.

- Ready to buy? Position yourself to be a strong buyer. Meet with your lender and obtain a current loan pre-approval . Work with your Realtor® to educate yourself on neighborhoods, schools, recent sales prices and list vs. sold statistics, commute times, etc.

- Expand your options – maybe the home that fits your lifestyle isn’t a house. Don’t rule out a condo or townhouse which can offer a single family lifestyle with lower maintenance responsibility, a great alternative if you don’t want a lot of yard or exterior home maintenance.

2018 is expected to be another challenging real estate market for buyers and sellers. Be patient. Be flexible. Be ready to move quickly.

Robin is a Realtor® with Windermere Real Estate/East. She lives and works in Bellevue and specializes in the Eastside’s condo and townhome communities.

Time to Sell an Investment Property?

Interest in rentals remains strong, but there’s been a noticeable slight decline in area rents this year. Even in high demand urban areas, rents have dipped slightly. With thousands of new apartments recently completed or nearing completion, and hundreds more under construction, rental supply may have begun to outpace demand.

If you own a rental property there will be more competition the next time you negotiate a lease renewal. Hundreds of new apartments are available offering modern finishes, new appliances, high tech features and a long list of community amenities and services. Tenants may not be as quick to accept a rent increase or lease renewal when, for the same money, or attractive lease-signing incentives, they can move into newer digs.

If you’ve owned your investment property for a while, this may be the time to sell and maximize your return on investment. Available inventory for sale is at historic lows and buyer demand is at an all time high – the perfect storm if you’re a seller. Properties sell quickly, often with multiple offers. Renting or selling, your property needs to be in good condition, but any minor cosmetic investment will translate to a major return when you sell.

Need market information? I’ve lived and worked in downtown Bellevue for over 30 years – there isn’t much I don’t know and love about the city. A Realtor® and condo specialist for over two decades, I combine my knowledge of the city with years of condo experience to advise and guide clients through the process of buying or selling a home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link